FROM CENTRALISED TO DISTRIBUTED

"If we approach this in the right way, it will spark a 21st Century Renaissance. A flourishing-forth of art, science, wealth and culture not seen since the Middle Ages."

WHAT IS THE PROBLEM?

I MUST CREATE A SYSTEM OR BE ENSLAVED BY ANOTHER MAN’S. I WILL NOT REASON OR COMPARE, MY JOB IS TO CREATE.

William Blake, Jerusalem: The Emanation of the Giant Albion

We live in an era of unprecedented Centralisation.

Cultural, economic and political activity is largely dominated by a tiny number of increasingly powerful global institutions and wealthy individuals, at the expense of everyday citizens.

This process of Centralisation has been going on for decades, maybe centuries, and is driving levels of wealth inequality not seen before at any point in human history.

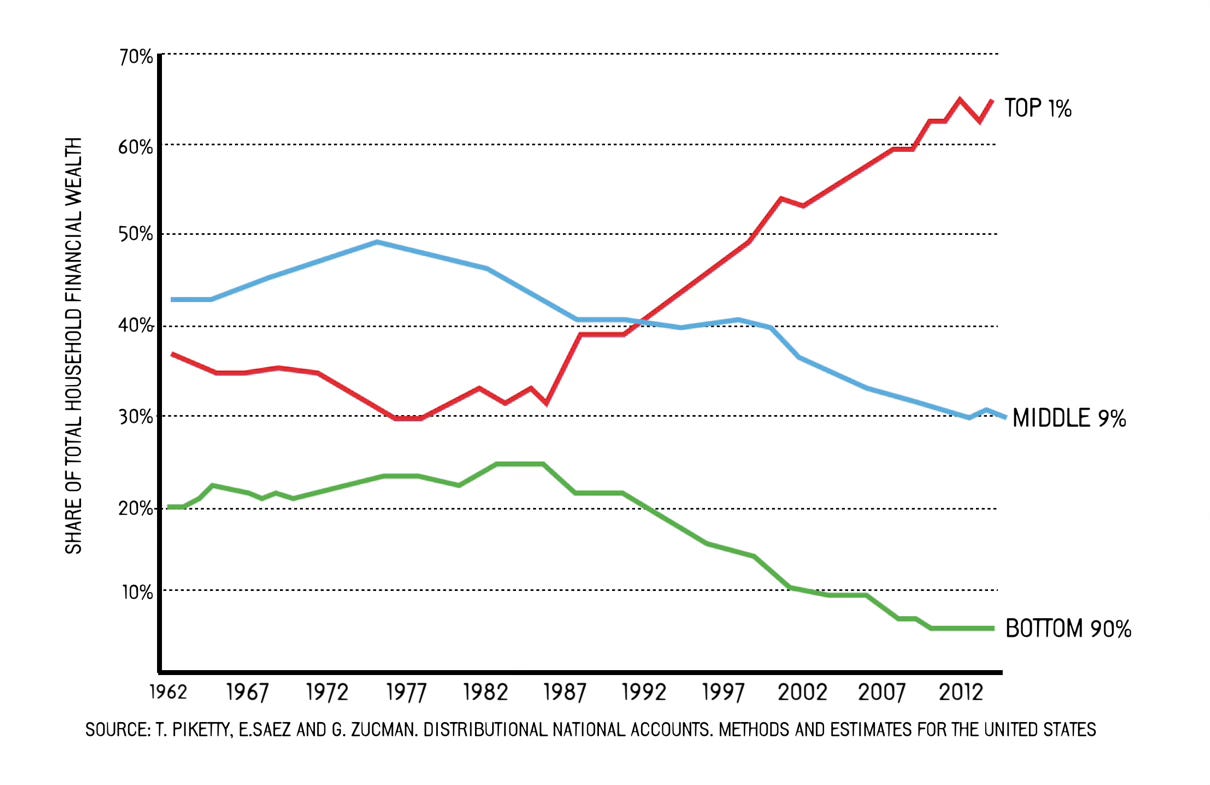

Between 1962 and 2014, the amount of wealth controlled by the wealthiest 1% of US Citizens nearly doubled at the expense of the 99%. A trend which has no doubt continued, and almost certainly accelerated, in the 10 years since. Not least as a consequence of global COVID lockdowns, the associated destruction of small independent businesses and mass-deployment of digital technologies that have transformed every area of society.

We assess the trend visualised above is broadly consistent across the Western world. Including the United Kingdom and, by extension, England, where PATTERN is based.

We now have a supranational, self-proclaimed ‘elite’, earning at least $1m a year, who own and control everything (the 1%). While increasingly-impoverished middle and working classes (the 99%) are left with scraps from the table and rapidly-diminishing opportunities to establish long-term prosperity and a meaningful position within society.

The most important thing to understand is this isn’t an accident.

The Point Of a System Is What It Does (POSIWID).

This concentration of wealth and power into the hands of an increasingly distant global 1% must be understood as a deliberate, well-funded and tightly-coordinated plan to deliver that exact outcome.

This presents an existential threat to the vast majority of humanity.

HOW WILL WE SOLVE IT?

YOU NEVER CHANGE THINGS BY FIGHTING THE EXISTING REALITY. TO CHANGE SOMETHING, BUILD A NEW MODEL THAT MAKES THE EXISTING MODEL OBSOLETE.

Buckminster Fuller

We need a radical new approach to running our society that sits outside the existing paradigm. An existing paradigm which has been designed to strip wealth from the many and give it to the few. To destroy Nation states, deny inalienable rights and subjugate humanity under Global governance.

To secure our future, we must rebuild. By distributing knowledge, potential and opportunity back into the hands of Citizens; respecting local cultures and traditions; and unlocking the potential of the unparalleled levels of knowledge, wealth and technical capability that exist within our Nation.

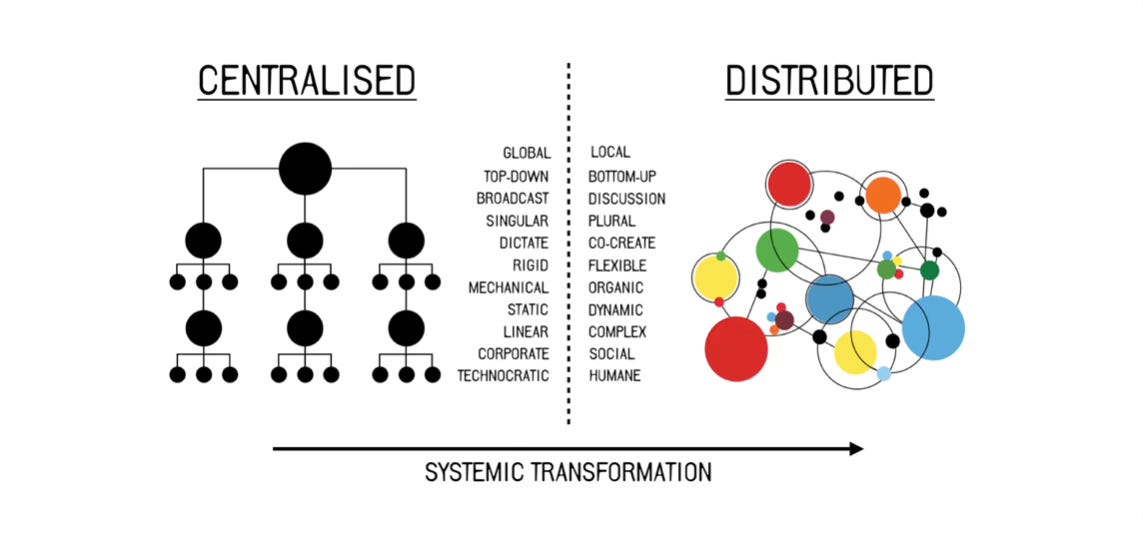

We need a Systemic Transformation. A wholesale migration from a top-down, Centralised model which concentrates power and prosperity in the hands of a tiny unaccountable ‘elite’, to a bottom-up, Distributed model which shares knowledge, power and prosperity as broadly as possible across society.

To deliver this Transformation, we’re building a National community of Active Citizens focused on establishing new value-creating systems to replace those controlled by the 1%.

This means new businesses.

New social endeavours.

Even new forms of governance.

Everything is on the table.

If we approach this in the right way, it will spark a 21st Century Renaissance.

A flourishing-forth of art, science, wealth and culture not seen since the Middle Ages.

Our community will:

Reconsider the role of Market, Church and State, and create new societal structures that meet the needs of individual Citizens, their families, communities and the Nation as a whole.

Acknowledge traditional values and ancient culture as the foundations on which future prosperity is built. Old ideas are still around because they’re successful.

Harness the power of a new Free Market, rooted in sound ethical principles, as our ‘engine’ of growth and transformation. This means we understand the value of entrepreneurial incentives in driving systemic change, but this cannot come through degradation of Citizens or nature itself.

Prioritise small, local, independently-owned businesses with short supply chains over global and even national corporations. We will ‘vote with our wallets’ across every area of the economic system: from food to advanced technology.

Encourage and accelerate participation in a mass ‘Exodus’ from big tech platforms. Advocate a significant (total?) reduction in wireless device usage across the entire population.

Accelerate adoption of new currencies, whilst not issuing one ourselves. Our goal is social utility and an honest wage, not a new 1% of crypto-whales pulling money out of thin air.

Understand that outsized opportunities always come from outside mainstream thought. Real creativity is hard. It requires patience. Experimentation. It must be nurtured. Make space for human ingenuity to flourish, then wait.

Uncover opportunities for Real Growth, defined as an even balance of Economic, Technological and Spiritual value creation. This in opposition to the existing paradigm which pursues a combination of Economic & Technological value (aka Money & Power) at the expense of Spiritual value (aka Righteousness).

Reject all forms of Global governance and ground ourselves in the fundamental, inalienable, God-given rights enshrined in Magna Carta. Most notably the right to trial by a jury of our peers.

Consciously reintegrate disparate academic and technical disciplines in order to establish a more nuanced and coherent perspective on the challenges we face. Encourage free, open, uncensored public debate across the full spectrum of societal challenges, diagnoses and solutions.

Uphold Free Speech as an inalienable right and embrace the iterative process of Conjecture and Criticism that is the source of all knowledge creation, wealth and prosperity.

Encourage self-reliance, individual character and the ability to thrive away from Centralised systems of support and control. This, paradoxically, being the best way to ensure all members of the community are cared for.

Understand that great Civilisations are built through a ‘grand collaboration’ between Citizens aligned by a shared vision and purpose.

Act in defence of England and its Citizens at all times.

TAKING ACTION

IF YOU WANT TO GO FAST, GO ALONE. IF YOU WANT TO GO FAR, GO TOGETHER.

Japanese Proverb

COMMUNITY

Bring together Active Citizens from across the UK to participate in this Systemic Transformation.

Create an environment where Active Citizens at all stages of their career and from all walks of life can confidently participate in building a Distributed future.

Establish Communities of Interest around academic topics, technical disciplines and trades.

Establish core teams and collaboration networks in 6 initial focus Markets: Agriculture, Healthcare, Education, Finance, Energy, Media.

Motivate, engage and elevate the community.

IDEAS

Curate discussion of philosophy, history, science, art, music and every other part of the human experience. Our ambition is a Renaissance.

Codify a core body of knowledge, vocabulary, taxonomy and ‘operating system’ for collaboration across the community.

Establish strategic perspectives and canonical knowledge in initial focus Markets.

ACTION

Highlight and experiment with practical solutions in initial focus Markets.

Run incubator / accelerator programmes to identify and progress high-quality ideas and practical solutions.

Coordinate and participate in an open-source ecosystem built on privacy-first technologies and an ethically-sound, non-predatory approach to intellectual property.

Experiment with advanced tech outside of the existing paradigm. In particular looking at Tesla’s branch of Physics and the potential for distributed energy systems.

Curate a collaborator, advisor and investor network committed to delivering this strategic plan.

Ben Rubin

Founder, PATTERN

UPDATED 1 JULY 2025

Dear Ben, you’re absolutely correct. Like you, I observed what I called The Dirty Snowball gobble up larger and larger pharmaceutical companies through the first two thirds of my career (late 1980s to mid noughties) to the point that few, very large corporations dominated the world.

We joked that it was one of the many industries in which you could work for four different companies without leaving your office.

Size was always the ostensible motive, because R&D was becoming more and more expensive as well as *less successful. Almost everything failed to reach market or to be profitable because of poor efficacy or unacceptable side effects.

I expected the industry to all but vanish during my working life. They should have vanished. They’ve stopped producing anything useful.

What must have happened in parallel with consolidation was regulatory capture. I’ve no doubt that there has always been sporadic corruption. I remember an FDA Advisory Committee (AdCom) for a drug that was in our view hopeless which then was approved by a unanimous vote. This was around 1990. It was a market failure.

But while we slept, big pharma board rooms and the seniormost leaders of FDA merged, probably catalysed by back room conversations at Davos.

While many of us can see this expression of centralisation so clearly and can even paint the steps leading to it in this specific & highly relevant example, Ben has become aware of this kind of phenomenon much more broadly.

We’ve been gulled into accepting the inevitability of globalisation. We’re told that it’s “progress” & you can’t prevent it. It’s at minimum an organic process though obviously it can also be steered.

The dirty secret is that those who were in corporate early on, and were talented enough not to have been fired eariy in this journey of consolidation, did well financially out of globalization. Such people were paid generously to assist in merging all these functions (“building the prison camps”).

They were then advised to sock away large, tax-relieved sums into their private pensions and then to invest those savings into the shares of those companies who were busy ensuring that their profits grew, corruptly if need be, yielding astonishing returns.

Guilty as charged. I never once thought of the wider implications of what I could see happening in my own sector when applied to the wider economy.

It’s everywhere. Virtually nothing has escaped the clutches of globalization and more specifically centralisation.

The result is that a handful of people can affect substantial parts of the lives of most people on earth. This is without precedent in human history.

Swimming against the tide might seem impossible, but it really isn’t. If you want no more than to turn your back on corporate life in all its many forms and to connect with people locally for as many of your needs as possible, you absolutely can.

Only in this way do we stand a chance of creating a network of people which is resistant to the baleful and totalitarian practices of globalization.

*there is an important silver lining to this cloud. Pharma hasn’t got worse at inventing the rare, genuinely useful drug. What’s happened is that the very patent system which grants the innovator a limited duration of commercial exclusivity has created a deep thicket of off patent, low cost drugs. They don’t go away when the patent expires. The existence of the blockbuster drugs of the past inevitably formed a portfolio of affordable medicines. Most aren’t particularly safe and effective, but some are.

I vote that we create the draft shortlist of generic drugs we should have access to.

Ben, this is brilliant! The ecosystem we have all become accustomed to existing in is becoming obsolete in the lives of those whose human instincts are drawn by other, more local and human friendly endeavours. I see it everywhere, you capture the hope so well, thank you